ST Wealth

Financial Advice

Schedule A Free Financial Plan Consultation

A ST Wealth financial plan consultation is a tailored approach to your personal finances.

Our first consultation is about understanding key areas we can strategically improve your financial position.

ST Wealth Management & Financial Planning

Wealth Management

Tax minimisation through strategic asset structuring whilst building investments in diverse asset classes

Self Managed Super Funds

Reducing the risk that comes with SMSF freedoms. Setting up, staying on track with audits, effective tax & retirement planning.

Financial Planning

Clearly know what you’re on track for financially and understand the decisions you make for yourself & your family.

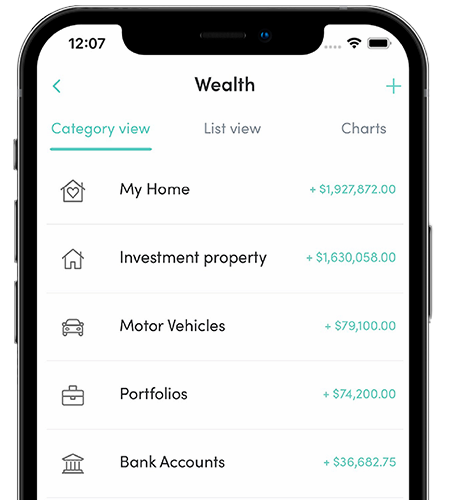

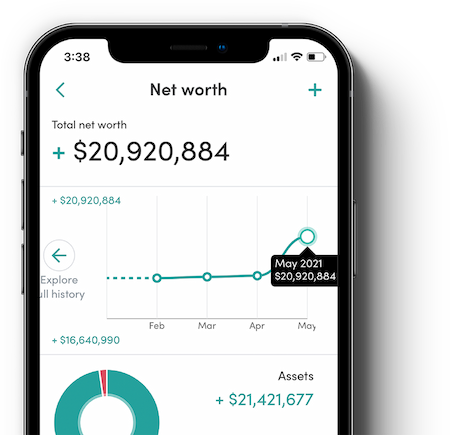

Online Wealth Portal

Your Wealth Portal tracks all your finances in one place. Income, insurances, assets, financial goals & more.

Budgeting Plan & Cash Flow

Personal budgeting plan and cash flow management with tracked, refined, & visual cash management strategy.

Insurances

Personal Insurance designed to protect you and your family in a variety of scenarios. Including: Life (Death Cover), Total Permanent Disability, Income Protection, Trauma Critical Illness, Buy/Sell and Key Person

Building Your Financial Future With Clarity

Personal advice for your finances. We believe in experiences, not transactions.

Future

Email ST Wealth

Send us an email here to organise a quick chat.

(In the meantime we’ll send you our latest Ebook)

It’s a free call and first consultation where we can help you understand where you have opportunity for improvement.

Know what your on track for financially

Protect your income from the unexpected

Schedule a Free Consultation

Your Online Portal

For Full Transparency

Blogs & Resources

ST Wealth: Education Bonds

Explore Education Bonds for a Bright Financial Future The Futurity Investment Group Cost of Education Index revealed that it costs a staggering $357,931 to send a child to an independent school in Sydney.Education Bonds are a special type of investment that...

ST Wealth Market Update • May 2023

Given the flow of mixed economic news, we thought it was a good opportunity to get in touch and share our latest perspective with a market update. Market Backdrop It is true that the market is facing mixed messages and cross currents at present. On one hand, we’ve got...

How can life insurance protect you and your family?

Did you know that most superannuation funds provide default life, permanent disability (TPD) and income protection to its members? Unfortunately, many people give far more consideration to their car insurance than they do their life insurances. The advisers from...

Email ST Wealth

Send us an email here to organise a quick chat.

(In the meantime we’ll send you our latest Ebook)

It’s a free call and first consultation where we can help you understand where you have opportunity for improvement.

Legal tax minimisation