When 2022 kicked off it seemed as though it was on track for a predictable course. Isolation periods began decreasing, states began opening borders and we had a date for when we could travel overseas! This allowed businesses to reopen, causing some labour tightening and an increase in the cost of goods and services, but ultimately, the world was poised for the unwinding of fiscal and monetary policy.

Russia’s invasion of Ukraine has certainly changed a lot of those assumptions. There’s tragic proportions of human toll, higher food and energy prices which has created significant uncertainty in the macro-economic environment. We are going to see higher global inflation and this is also going to have a drag on economic growth.

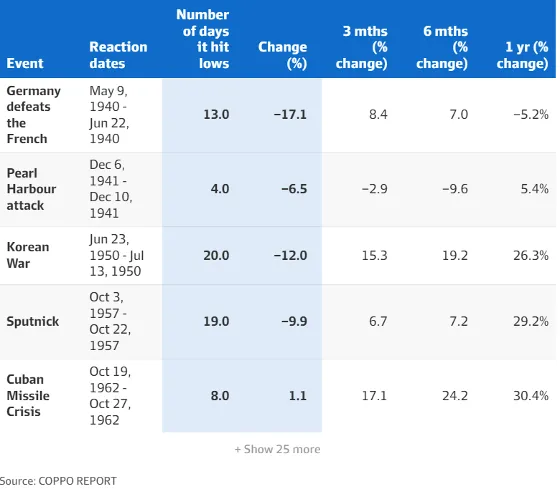

When it comes to investing, it is near impossible to factor in geo-political issues as the outcomes are impossible to predict. However, in saying that, they tend to not be long lasting. There are always geo-political issues and sadly there is regular military conflict (Iraq, Afghanistan, Syria, Yemen and Ukraine, just in the last decade or so) and they tend not to have a lasting impact on markets.

What does history tell us about how markets rebound after a geo-political crisis? They are usually swift and powerful from the initial fall caused by even the most severe crises. Global firm Ned Davis Research has observed the same trend. Noting that based on multiple crises since 1907, the US share market declined on average by 7%, but 6 months later was 10% and 15% higher after just one year. It is quite normal for us to be quite fearful of a conflict and be forgetful about the lessons we learned from the previous one. Invariably, it is because we have short memories.

Overall, when it comes to investing for the long term it is extremely important to remain true to the course, hold your nerve and look for buying opportunities.

If you would like to review your existing portfolio, or if you recognise that now might be a good time to establish a strategy, please feel free to contact us here.