Happy New Financial Year! It’s tax time again!

We are excited to be working with you during the new financial year and looking forward to being partners in your success.

To ensure you remain abreast of any changes and developments in the superannuation space, please make sure you read the following important information:

Reminders:

You can also download and customise your own important dates calendar here.

Tax Lodgement Due Dates:

- Most Self-Managed Superannuation Funds (SMSFs) will have a lodgement and payment date of 15 May 2025.

- If your SMSF is newly registered and 2024 will be its first tax lodgement year; lodgement and payment is due by 28 February 2025.

- If you had any returns outstanding as at 30 June 2024, the 2024 return will have a due date of 31 October 2024.

SMSF with investments in property

If your SMSF has an investment in a commercial or residential property, please obtain a market appraisal of all investment properties as at 30 June 2024. This appraisal must include comparative values of similar properties recently sold or for sale, otherwise, it will not be accepted by the SMSF Auditor.

For properties that are leased to related parties, please provide a rental appraisal as at 30 June 2024, including comparative rents for similar properties.

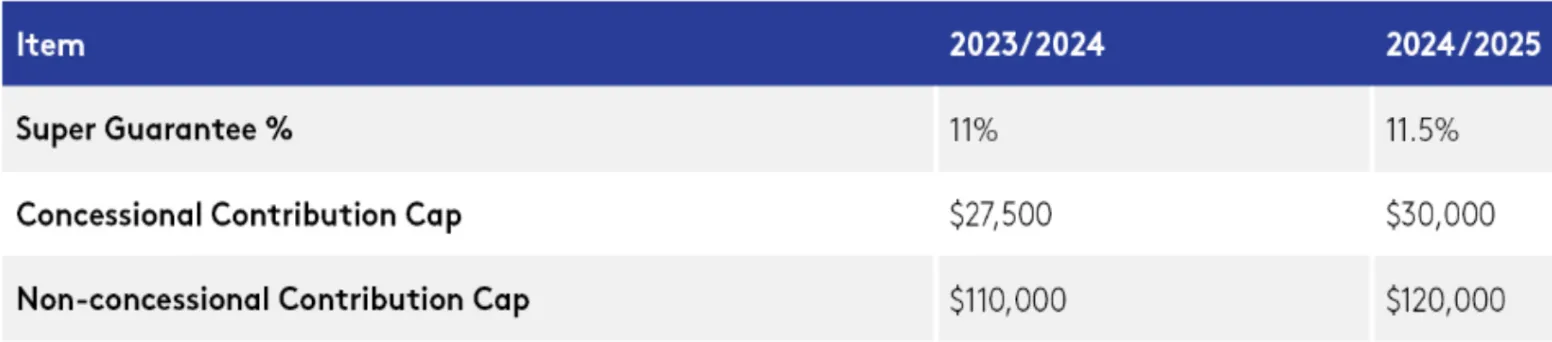

Increase to Superannuation Guarantee & Contribution Caps

On 1 July 2024, the following rates and caps apply:

Pensions

The Pension minimum drawdown percentages from 1 July 2024:

If you would like assistance with your retirement plan, please contact us.

Kind regards,

The ST Wealth Team